Compute payroll taxes

Many companies do compute their employees daily rate incorrectly. In addition you can store returns receipts donations and other tax documents for easy access.

How To Calculate Taxes On Payroll Deals 56 Off Www Quadrantkindercentra Nl

Examples of Payroll Accounting.

. Rippling offers comprehensive employee management features and customizability at a reasonable price. When and how you acquired the assets. Taxes are not fun and compiling the data is even worse.

The higher the employees taxable income the higher the tax rate. Payroll Taxes Paid by Employers. Talk to an expert at PayrollHero to see how our software platform can complete this for you at the click of a button whenever you want to.

Employers typically deduct taxes from employees on a monthly or semi-monthly basis. Executing payroll refers to the disbursal of salaries to the employees and the payment of statutory dues like PF PT ESI and TDS. Lets say that the calculation takes 15 seconds for your payroll department to compute and you have 100 employees.

Every employer who pays income subject to withholding holds back part of an employees wages and sends it to the Tax Commission. If you live in a state with no income tax the calculator should be accurate as-is. This is a count of all full-time and part-time employees who worked or received pay subject to the Nevada Unemployment Compensation Law for the payroll period which includes the 12th of the month.

It also includes calculating taxes and social security as well as ensuring that they are properly withheld and processed. The former is 1 calculation per employee per payroll the latter is 15 per employee. The system accepts withholding tax data files such as spreadsheets or text files created using payroll software.

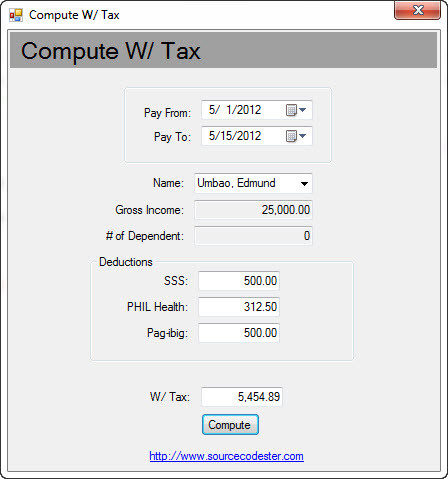

How much is your SSSPhilhealth and PagIbig contributions. Payroll execution is what sets RazorpayX Payroll apart from other solutions. That is above minimum wage earner so you should deduct taxes to the employees salary assuming that there is no other.

If your taxes are over-withheld use the withholding calculator to find the right number of allowances that will leave you with more money in each paycheck while still making sure that enough is withheld to cover your tax when you file your return. See pages 6 7 8. However they do not execute payroll.

ESmart Paycheck is a free payroll calculator that can quickly compute payroll for hourly or salaried workers while taking care of 401k contributions and other deductions. Dont Forget Employer Payroll Taxes. The applicable federal income taxes Federal Income Taxes Federal income tax is the tax system in the United States and is levied and governed by Internal Revenue Services IRS.

Create Federal forms 941 940 W-2 W-3 and state forms Real-time update of taxes and tax forms based on saved checks. It offers questions to help users file their taxes. Let us take an example of a business that has to pay 1000 to an employee.

It typically involves keeping track of hours worked and ensuring that employees receive the appropriate amount of pay. Allowances and other benefits if any. You must keep records to verify certain information about your business assets.

Apply the taxable income computed in step 3 to the following table to determine the annual New Jersey tax withholding. You can import federal filing data for state taxes calculation. Documents for assets should show the following information.

The depth of its tools and flexibility may overwhelm some smaller businesses but compensating. It helps determine the tax charged on the income earned by individuals corporations and. By engaging CloudCfo you can be confident that when the times come to compute your Withholding Tax on Compensation the information will be ready accessible and most important.

You need records to compute the annual depreciation and the gain or loss when you sell the assets. Payroll management system encompasses all the tasks involved in paying an organizations employees. The CloudCfo Team are experts when it comes to supporting businesses in the Philippines with their payroll computations and payroll tax and compliance obligations.

Now this might seem insignificant if you are just starting a company but it will become more apparent at scale. Add earning and deduction items tips 401kPOP child support etc Accurately calculate and track Federal and state taxes. To compute the withholding tax use the Virginia Employer Withholding Tables.

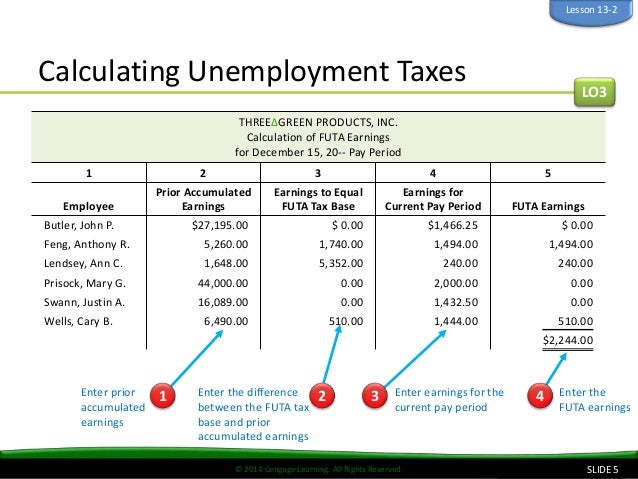

Cost of any improvements. It doesnt compute the effect of your payroll adjustments on your state or local tax withholdings. Unemployment Insurance UI The 2022 taxable wage limit is 7000 per employee.

Payroll offices and human resource departments are responsible only for processing the Form. Section 179 deduction taken. Note however that employees with annual wages totaling PHP 250000 or less are tax-exempt.

Revenue Ruling 2009-39 describes how an employer corrects employment tax reporting errors using the interest-free adjustment and refund claim processes under. The payroll tax liabilities that are paid by the employer are noted below. On Part 3 of Form 941-X you will enter the corrections for the quarter and compute the tax due or overpayment.

All cash tips received by an employee in any calendar month are subject to social security and Medicare taxes and must be reported to the employer. The UI maximum weekly benefit amount is 450. How to Compute Taxes for Payroll in the Philippines.

The following is required information for you to compute your income tax. Our Boss wants to change the payroll dates from every 15th and last day of the month to every 7th and 22nd day of the month and also the cutoff period. You must have a federal Form W-4 Employees Withholding Allowance Certificate on file for each employeeWe strongly.

These numbers are used to compute the maximum weekly benefit amount and the annual taxable wage limit. You can also file form 1040 and Schedules 1-6. How to Compute Philippine BIR taxes.

Payroll agencies and most HRMS simply compute salary dues along with statutory liabilities. Heres an easy way on how to compute employee taxes for the month. All cash and non-cash tips an received by an employee are income and are subject to Federal income taxes.

You must make deposits with the IRS of the taxes withheld from employees pay for federal income taxes FICA taxes and the amounts you owe as an employer. Specifically after each payroll you must. And trace it to payroll to validate how the distributed service charges were paid out to.

February March payroll taxes reported on Form 941. E-pay directly to IRS from your account. I already file withholding taxes for my household employees on a quarterly basis and I prefer to keep my books that way.

HR Block simplifies e-filing tax returns by providing customized tax prep options. 25 year. The UI tax rate for new employers is 34 percent 034 for a period of two to three years.

An income tax withholding is not technically a tax but rather an advance payment to the government on the income tax that employees will compute following the end of the tax year. Determine the exemption allowance by applying the following guideline and subtract this amount from the annual wages to compute the taxable income. If you live in a state with more complicated payroll taxes such as New York or Maryland state-specific calculators can help to check that youre withholding the right.

Copy of the BIR Tax table. Exemption Allowance 1000 x Number of Exemptions. This section describes how to determine the amount to withhold.

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

How To Compute Withholding Tax On Compensation Bir Philippines Business Tips Philippines

Payroll Tax Deductions Business Queensland

How To Calculate Taxes On Payroll Deals 56 Off Www Quadrantkindercentra Nl

How To Calculate Taxes On Payroll Deals 56 Off Www Quadrantkindercentra Nl

How To Calculate Taxes On Payroll Deals 56 Off Www Quadrantkindercentra Nl

How To Calculate Federal Income Tax

How Payrollhero Computes The Philippine Bir Tax Deduction Payrollhero Support

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

How To Calculate Taxes On Payroll Deals 56 Off Www Quadrantkindercentra Nl

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate Federal Withholding Tax Youtube

Payroll System How To Compute Withholding Tax Free Source Code Projects And Tutorials

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Taxes On Payroll Deals 56 Off Www Quadrantkindercentra Nl

How To Calculate Taxes On Payroll Deals 56 Off Www Quadrantkindercentra Nl

Sap Hcm Us Payroll Tax Calculation Illustration Sap Blogs