Taxes off a paycheck calculation

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Texas residents only. Congratsthat was the hardest part and every other calculation is much more straightforward.

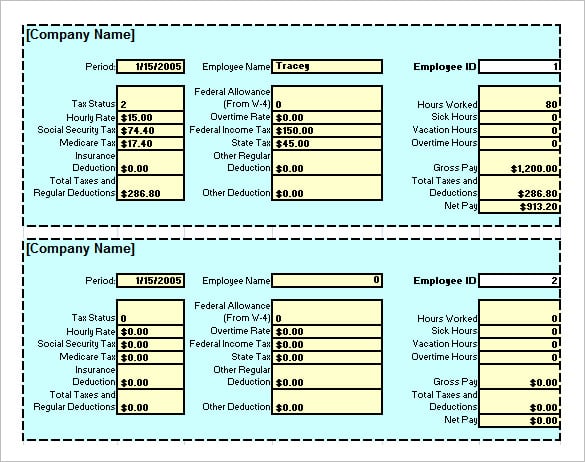

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

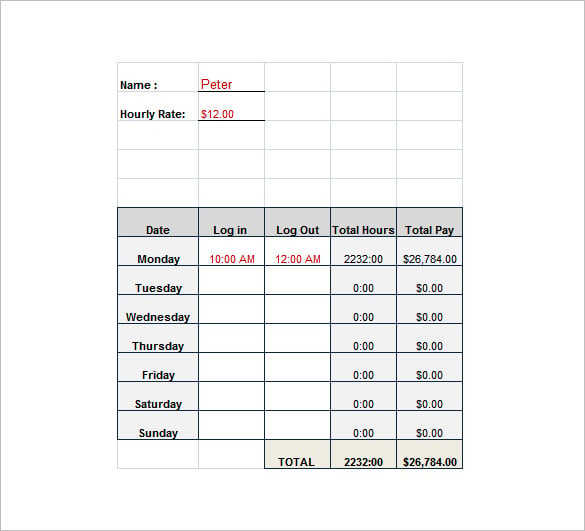

The first step to calculate payroll taxes is calculating the wages earned by each employee and the amount of taxes that need to be withheld as part of running payrollYou also need to make deductions for items such as retirement benefits health insurance and garnishments.

. Once your employees are set up and your business is set up too youre ready to figure out the wages the employee has earned and the amount of taxes that need to be withheldAnd if necessary making deductions for things like health insurance retirement benefits or garnishments as well as adding back expense. It is not a substitute for the advice of an accountant or other tax professional. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Florida residents only.

In most cases your net pay appears in larger font on your paycheck or pay statement and is often bolded to appear darker so that you can easily distinguish it from your gross pay. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time.

150000 a Year Salary After Taxes in 2022 By State Here is your estimated 150000 a year salary after taxes in 2022 for each state. For starters not all states have an individual income tax which takes one more deduction off your plate. Since FICA taxes are based on a flat rate calculating the deduction.

Deductions from gross pay. How to Ask for a Raise. If a company reports more tax revenue than book revenue in the current period it will prepay its taxes.

Arizona 106886 Arkansas 104194 California 101454 Colorado. In other words a deferred tax asset is the opposite of deferred tax liability. Should total 153 of each employees paycheck.

The tax summary shows the total amount your passengers paid for Uber booking fees as well as other fees such as tolls and split fare fees. Your gross income is the total amount of money you receive annually from your monthly gross pay. That means less taxable income and taxes to pay in the future.

It is not a substitute for the advice of an accountant or other tax professional. Medicare tax is a two-part tax where you pay a portion as an automatic deduction from your paycheck and your employer pays the other part. Calculating Employee Payroll Taxes in 5 Steps.

Your after-tax income will change based on state taxes. Cutting taxes would require taking on massive new debt the Congressional Budget Office projected a 10-year cost of the Trump tax cut at 15 trillion. The tax is based on Medicare taxable wages a calculation that uses your gross pay and subtracts pretax health care deductions such as medical insurance dental vision or health savings accounts.

Alabama 106020 Alaska 111960 State Income Tax 000 0. By one calculation Bezos could have. To get you off to a good start with your business tax deductions Uber provides you with a tax summary that breaks down the totals of the amounts on both your 1099-K and 1099-NEC.

For example the calculation for bad debt is different for financial accounting and tax. If your state does.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Amazon Com Appstore For Android

Understanding Your Paycheck

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Paycheck Calculator Online For Per Pay Period Create W 4

Colorado Paycheck Calculator Smartasset

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

How To Calculate Net Pay Step By Step Example

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Free Paycheck Calculator Hourly Salary Usa Dremployee

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Amazon Com Appstore For Android

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Amazon Com Appstore For Android